Melinda Jennison

Introduction

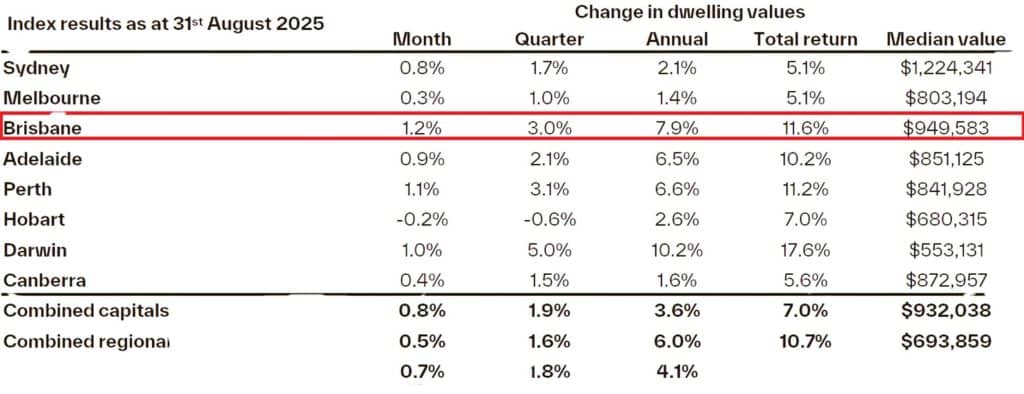

August was Brisbane’s strongest month since May last year, with values accelerating and buyer activity lifting again. Cotality’s (formerly CoreLogic) Home Value Index shows Brisbane dwelling values up 1.2% in August, 3.0% over the quarter and 7.9% annually, taking the city’s median dwelling value to $949,583. To put the current pace of growth in context, a 1.2% monthly rise is roughly $12,000 on a $1 million purchase price.

Brisbane was the top-performing capital city on monthly growth, and remained well ahead of the combined regionals pace. On a quarterly and annual basis Brisbane remained in the top three capital city markets for growth momentum.

Two policy settings are likely to add further demand in coming months. First, from 1 October 2025 the expanded Home Guarantee Scheme opens to all first-home buyers (no income caps, higher price caps, unlimited places) with 5% deposits and no LMI, which will shorten deposit-saving times and pull forward demand. In Brisbane, that means purchasing up to $1,000,000 could require just a $50,000 deposit plus costs. This will be a powerful catalyst at a time supply remains tight.

Second, the 25bp cash rate cut in August (to 3.60%) has already improved borrowing capacity. There are expectations that further easing will depend on inflation and demand pressures, noting that heavy take-up of first-home assistance could temper the RBA’s path.

Construction is also busy on paper. The latest CoreLogic Cordell data indicates ~$1.5 billion in Queensland projects in the pipeline, ~$700 million earmarked for new residential, and ~$321 million of residential projects commencing in July. Yet pipeline volume isn’t the same as fit-for-purpose supply.

On the ground, demand is strongest for well-located townhouses and boutique apartments, while much of the new product skews to high-rise at premium price points or to fringe-area land release. That gap keeps pressure on the limited stock that truly matches buyer preferences and budgets in inner and middle-ring suburbs.

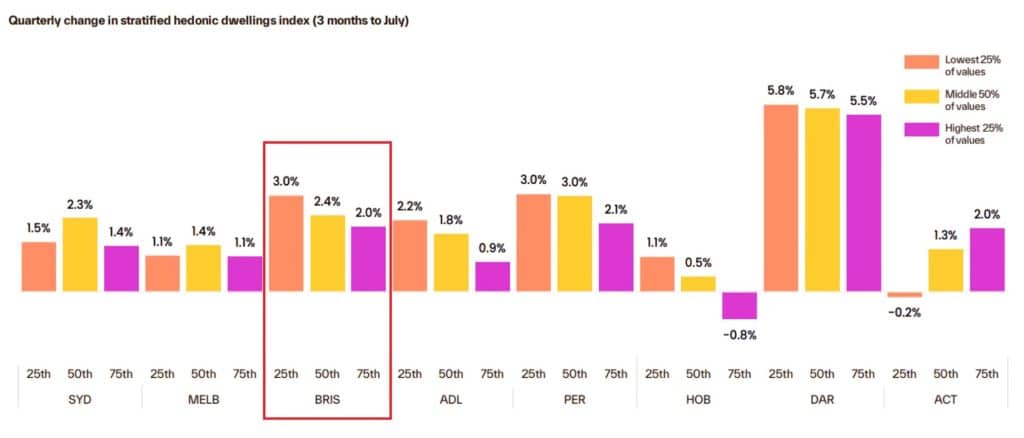

Nationally, houses have generally outpaced units this year, but not in Brisbane. The unit market continues to lead here. Affordability is a key driver, with the lower-value quartile is rising faster than the top end. Sales are also turning over quicker in entry-level segments. Auction activity is stronger and properties are moving faster, with median days on market falling to 23 in August from 25 in July.

Tight listings remain the story. According to SQM Research, total listings lifted modestly to 16,106 in August (from 15,659 in July) but are still 11.6% lower than a year ago and well below the 28,000–30,000 long-run average for Brisbane. New listings were 6,867 in August, 15.7% lower year-on-year. This persistent supply-demand mismatch remains the key upward pressure on prices.

Brisbane Dwelling Values

Brisbane’s median dwelling value is $949,583 as at August, up 1.2% month-on-month, 3.0% for the quarter and 7.9% year-on-year and ahead of the combined capitals on all three timeframes. By comparison, Sydney posted 0.8%/1.7%/2.1% and Melbourne 0.3%/1.0%/1.4%.

Source: Cotality

Source: Cotality

Versus July, growth clearly re-accelerated (July’s monthly change was 0.7%). Cotality’s auction data also shows a healthy bidding environment, with Brisbane’s clearance rate averaging 67.13% in August, higher than 12 months ago in August 2024 when the clearance rate was 64.42%.

Stratified results for the three months to July show lower-quartile values outpacing the middle and upper quartiles across Brisbane. This is a pattern shared with Adelaide and Perth and is consistent with stronger affordability-led demand.

Source: Cotality

Source: Cotality

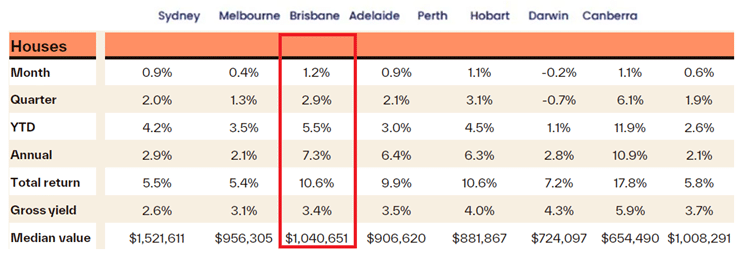

Brisbane House Values

Houses rose 1.2% in August, 2.9% over the quarter and 7.3% annually. The median Brisbane house value is $1,040,651. Momentum has picked up from July, when monthly growth was 0.7%.

Relative to other capitals in August, Brisbane’s monthly house gain (+1.2%) surpassed Sydney (+0.9%), Melbourne (+0.4%), Adelaide (+0.9%), and Perth (+1.1%). This keeps Brisbane in the leading group for detached housing performance.

Source: Cotality

Source: Cotality

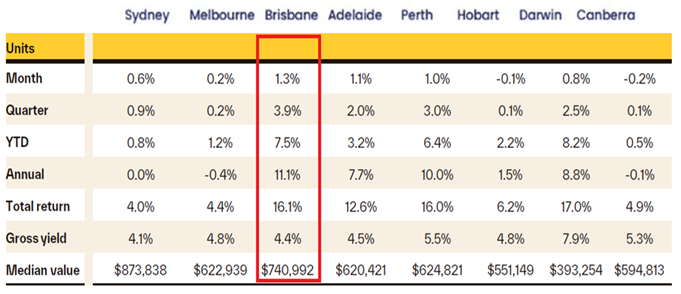

Brisbane Unit Values

Units continue to outperform houses in Brisbane. Unit values rose 1.3% in August, 3.9% over the quarter and 11.1% annually, lifting the median unit value to $740,992.

Compared with July, unit growth momentum edged higher, up from +1.1% last month. The affordability edge, investor participation and preference for well-located, lower-maintenance property keep this segment competitive.

Source: Cotality

Source: Cotality

Brisbane’s Rental Market

Rental conditions remain very tight. Vacancy rates held at 0.9%, unchanged on last month’s reading.

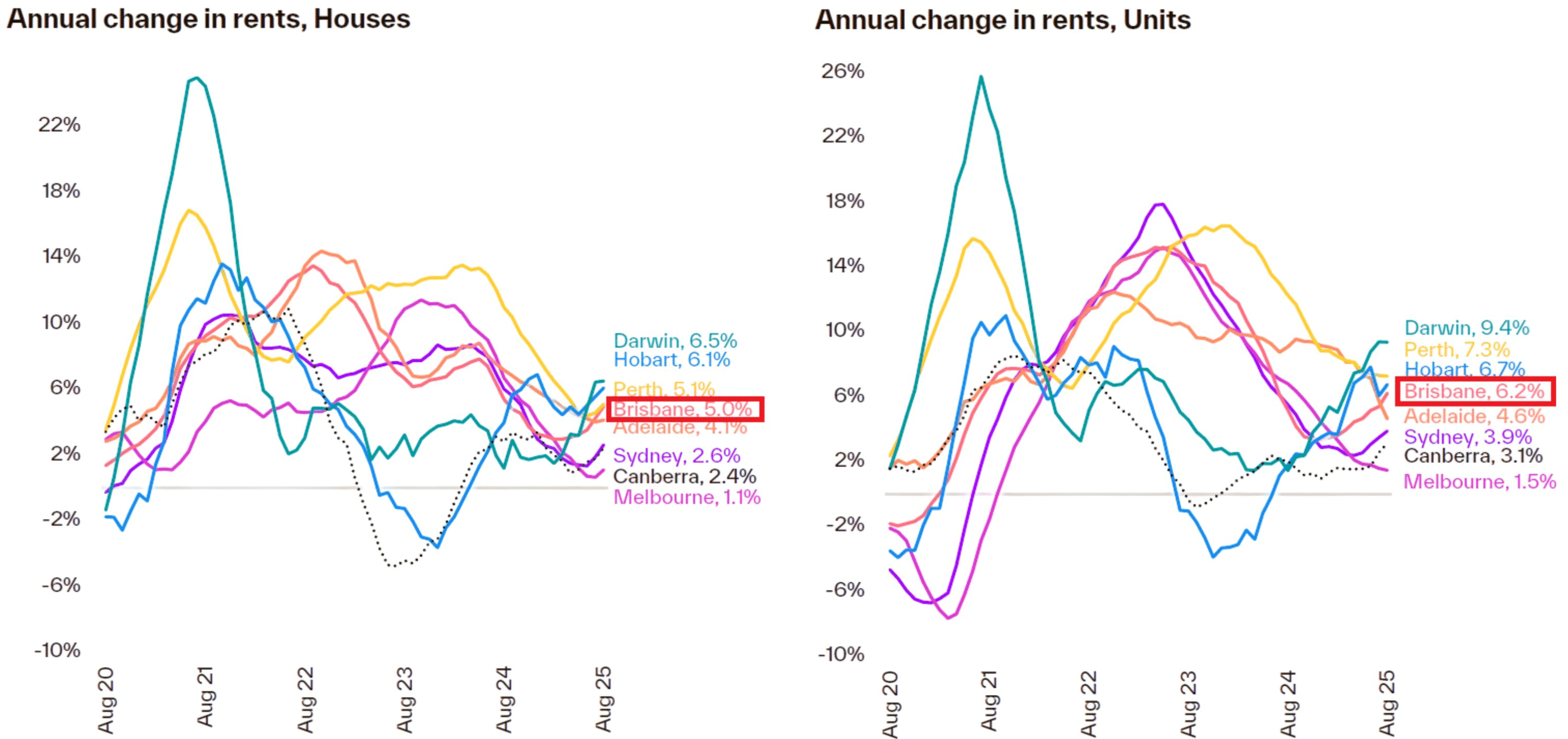

Rents are re-accelerating across both product types. House rents are up 5.0% annually (from 4.3% last month), while unit rents are up 6.2% (from 5.6%). Gross yields remain steady at 3.4% for houses and 4.4% for units.

Nationally, rental growth has been lifting in 2025 as vacancy rates sit near record lows, a trend Brisbane shares with most other locations nation wide.

Source: Cotality

Source: Cotality

Summary

Looking ahead, price growth is likely to remain firm through spring. Demand-side stimulus (rate cuts, first-home buyer changes) meets scarce, often-misaligned supply. On the ground, competition is intense. Multiple offers with 5–15+ bidders are common, and we’ve seen as many as 23 buyers on a single property recently. Auctions also continue to draw several registered bidders.

With values rising month-on-month, the opportunity cost of delay is real. Getting purchase decisions right, and transacting sooner, matters more than ever in Brisbane’s inner and middle-ring suburbs due to escalating prices.

For buyers, the practical takeaway is simple: focus on A-grade assets in A-grade locations, be finance-ready, and leverage a trusted auction bidding agent service to apply clear pricing frameworks and strategies that suit current market conditions.

Brisbane remains one of the nation’s frontrunners, with momentum, policy tailwinds and chronic undersupply likely to keep the city on a growth path into the final quarter of 2025.

We hope that you have found our Brisbane Property Market Update August 2025 helpful.

Connect with us today

To book a FREE discovery call ~ Click Here