Melinda Jennison – Streamline Property Buyers

Introduction

January is usually a softer month for housing markets. Sales volumes are lighter, many decision-makers are still shaking off the festive season, and it can feel like the market is idling until February. But Brisbane didn’t really follow that script this year.

From 5 January onwards, buyer activity in the affordable and mid-range segments came out of the gate strong. We saw early listings snapped up quickly by buyers who swapped beach days for open homes, and who were ready to act decisively when quality stock hit the market. When you layer that urgency over Brisbane’s still-tight supply conditions, it doesn’t take much for competition to flare.

The headline numbers back that up. Cotality’s January read shows Brisbane dwelling values up 1.6% for the month, 5.1% over the quarter, and 15.7% over the year, taking Brisbane’s median dwelling value to $1,054,555.

That is not the kind of start you see in a market that’s “cooling off”.

What’s important here is context. Brisbane isn’t the only capital city recording growth, but the pace and consistency of Brisbane’s gains continue to stand out. Across January, the combined capitals rose 0.7%, with Brisbane outperforming the broader benchmark (and sitting behind Perth, which again posted the strongest monthly growth at 1.9%). Sydney and Melbourne also returned to modest positive movement (0.4% each), which is a shift from the weakness seen in parts of late 2025.

Over the quarter, Brisbane’s 5.1% result again places it among the stronger capitals, with Perth leading at 5.7%, and the combined capitals recording a much lower 2.5%. Over the year, Brisbane remains firmly in the top tier at 15.7%, again behind Perth (18.2%) but ahead of most other capitals on annual growth.

That’s the broader national picture, but Brisbane’s market also has its own rhythm, and this is where local nuance matters.

Herron Todd White’s latest “Month in Review” commentary reinforces what we’re seeing on the ground. Brisbane’s performance through 2025 was underpinned by real drivers, not hype. They point to population growth, constrained housing supply, elevated construction costs, and Brisbane’s increasing profile ahead of the 2032 Olympics as key factors supporting demand across both owner-occupier and investor cohorts.

They also highlight that the standout story has been the strength of entry-level property, particularly in more affordable attached housing, where buyer demand has been fuelled by rents and tight vacancy conditions.

Their National Property Clock placements add another layer of insight. Brisbane is sitting among markets that are still performing strongly, rather than drifting into a true downswing phase, which aligns with the price momentum we are seeing in both houses and units.

Source: Herron Todd White

Finally, looking ahead, the KPMG Residential Property Market Outlook (January 2026) is very clear that Brisbane’s strength is expected to extend beyond 2026, supported by ongoing population inflows and supply constraints. KPMG’s forecast has Brisbane house prices rising around 11% through 2026 and units around 8%, before moderating in 2027 (with houses still forecast to grow strongly).

They also note that affordability pressures are likely to shape a “two-speed” market where the more affordable segment outperforms, while growth at the upper end is capped by borrowing capacity.

That theme, affordable product outperforming, is exactly what Brisbane has been doing for some time now.

Brisbane Dwelling Values

Brisbane’s overall dwelling market strengthened again in January.

Cotality’s data shows Brisbane dwelling values increased 1.6% over the month, 5.1% over the quarter, and 15.7% over the year, taking the median dwelling value to $1,054,555.

Source: Cotality

Compared to December, that quarterly pace has eased slightly (December’s rolling quarterly result was higher), but the bigger story is that Brisbane is still compounding from an already elevated base, and it continues to outperform most capitals on annual growth.

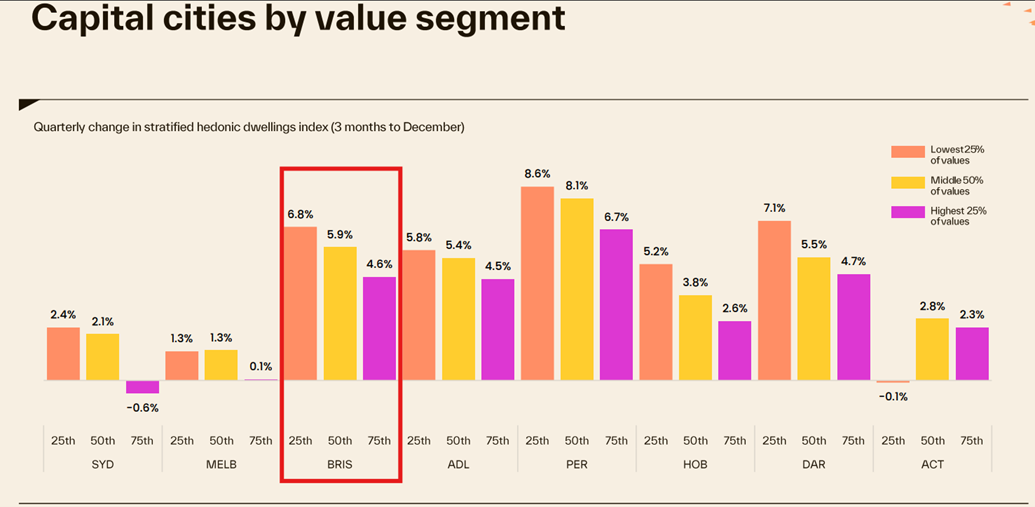

By market segment, the rolling quarterly growth continues to skew stronger toward the lower end, but the gap between segments is not extreme. In the three months to December, Brisbane’s lowest 25% rose 6.8%, the middle 50% rose 5.9%, and the highest 25% rose 4.6%.

Source: Cotality

For comparison, in the three months to November, the equivalent growth rates were 6.6%, 5.9%, and 4.7%.

The takeaway is that the lower quartile is still leading, but growth is being carried across a broader spread of the market rather than being isolated to one narrow segment.

It’s also worth noting that Proptrack’s January numbers show positive growth as well, with 0.4% monthly price growth for Brisbane dwellings, broadly consistent with the Cotality trend.

Brisbane House Values

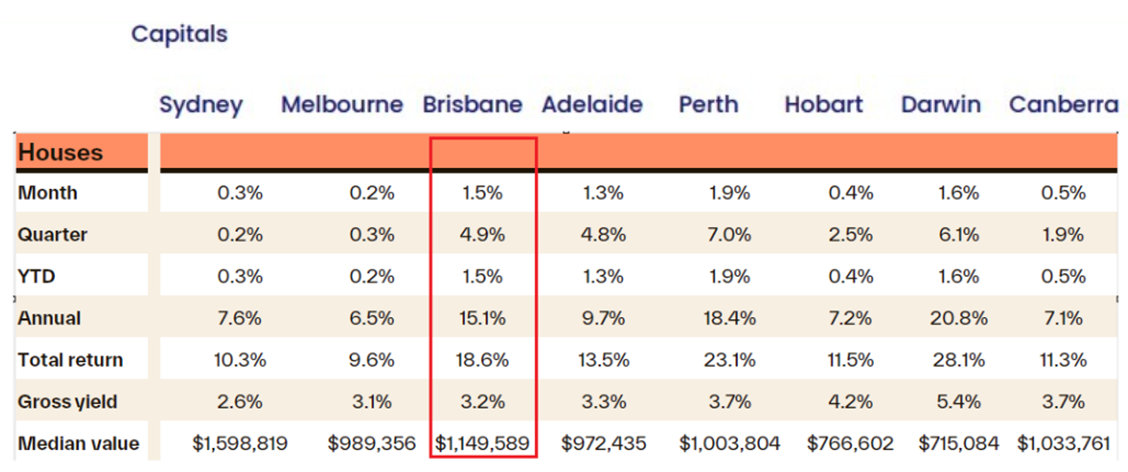

Houses remain the larger, steadier part of Brisbane’s market, and January reinforced that stability.

Cotality’s figures show Brisbane house values increased 1.5% over the month, 4.9% over the quarter, and 15.1% over the year, taking the median house value to $1,149,589.

Source: Cotality

Compared to December, the monthly growth rate is consistent, and the annual growth rate has lifted, reflecting that Brisbane’s house market is still absorbing demand even as affordability constraints become more visible at higher price points.

Against other capital cities, Brisbane’s annual house growth sits among the leaders nationally (again behind Perth on the annual ranking), while Sydney and Melbourne remain far more moderate over the year.

Proptrack’s January data also reports 0.3% house price growth across Brisbane, again aligning with the positive direction of travel shown by Cotality.

Brisbane Unit Values

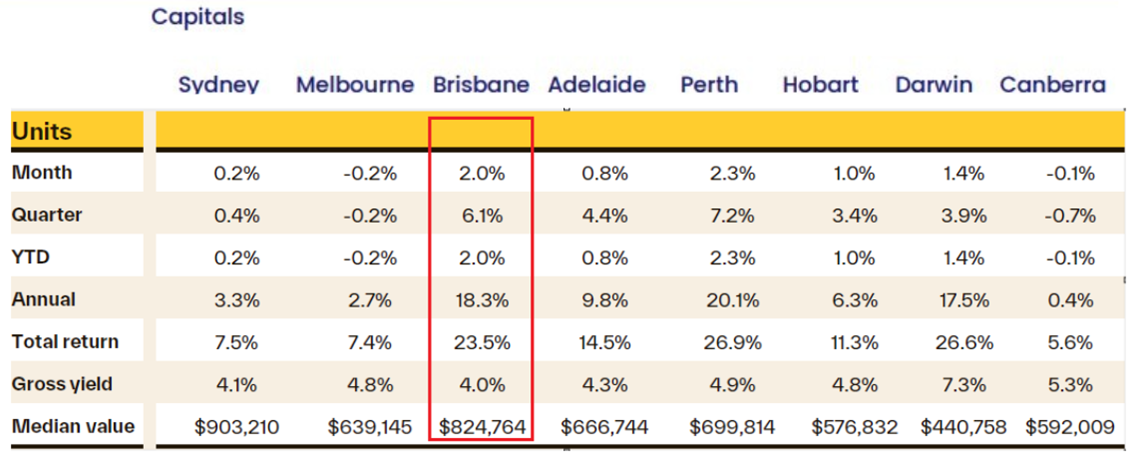

If there is one part of Brisbane that keeps surprising to the upside, it’s the unit market.

In January, Cotality reports Brisbane unit values increased 2.0% over the month, 6.1% over the quarter, and 18.3% over the year, taking the median unit value to $824,764.

That annual growth rate (18.3%) reinforces what many Brisbane buyers have learned the hard way – the unit market here is not a “second tier” option. In the right locations, with the right fundamentals and scarcity, attached housing has been a major beneficiary of affordability pressure in the detached market, and it has also attracted deeper investor interest due to rental demand.

Source: Cotality

KPMG’s outlook supports this theme nationally, noting that unit growth is expected to remain solid because attached dwellings provide lower entry points for buyers priced out of houses, particularly in capital cities where affordability is tightening.

Proptrack’s January unit result of 0.6% monthly growth also reinforces the same direction, even if the magnitude differs.

Brisbane’s Rental Market

Brisbane’s rental market remains tight, even with the normal seasonal movements that tend to show up around December and January.

Vacancy is still low, and while Greater Brisbane saw a seasonal adjustment in December (often linked to tenancy end dates around the holidays), the broader picture has not changed. Demand remains firm, and the pressure on rents is still evident.

Cotality’s January figures show annual rent growth of 6.3% for houses and 6.8% for units, suggesting rent growth is easing from the extremes of earlier cycles, but it has not disappeared.

Source: Cotality

For investors, gross yields remain relatively stable, but you can see the subtle shifts. House yields are sitting at 3.2% (unchanged from last month), while gross unit yields are now 4.0%, which is 0.1% lower than December.

That slight softening in unit yields is exactly what you’d expect when unit values are rising quickly, sometimes faster than rents can keep up in the short term.

The bigger message is that gross yields are still stronger in the unit market, but the competition for quality investment-grade stock remains intense, and the margin for error is small if buyers prioritise yield over fundamentals.

Summary

January has delivered a clear message. Brisbane has started 2026 with momentum intact. But the market is not without challenges ahead.

Inflation remains above the RBA’s target range, and with inflation ticking higher in December, the risk of at least one rate hike stays on the table. Even if the cash rate doesn’t move immediately, the expectation of higher rates can erode confidence, and any actual increase flows quickly into borrowing costs and reduced purchasing power.

Credit conditions are also tightening at the margin. APRA’s limits on high debt-to-income lending from 1 February set a more cautious lending tone for 2026, even if they don’t necessarily change the headline trend straight away. If investor credit growth remains elevated, that segment could draw more attention.

On the supportive side of the ledger, unemployment remains very low, which helps underpin demand. The federal government’s Home Guarantee Scheme and Help-to-Buy style initiatives are also still working their way through the market and will continue to stimulate eligible first home buyer demand, with flow-on effects across the whole chain.

And then there is the issue Brisbane cannot sidestep – supply.

Brisbane continues to face persistently low stock levels, and new construction remains well below what’s needed to meet targets. As KPMG notes, supply is lifting only slowly, and elevated construction costs remain a major barrier, which keeps the structural shortage in place and underpins prices, particularly in the affordable segment.

So where does that leave us as we head deeper into 2026?

In simple terms, the imbalance still favours a market where values can continue to rise, even if the pace moderates. Brisbane may not climb in a straight line, and affordability will keep testing some market sub-sections, but the fundamentals remain strong. The buyers who do best in this environment will be the ones who stay disciplined, understand the local nuance suburb by suburb, and act decisively when the right asset appears.

We hope that you have found our Brisbane Property Market Update January 2026 helpful.

Connect with us today

To book a FREE discovery call ~ Click Here