Melinda Jennison

Introduction

Brisbane’s Market Performance Holds Strong

July 2025 marked another chapter in Brisbane’s ongoing property market strength, with continued resilience in both house and unit values. Despite the seasonal slowdown typical of the school holiday period, the city once again outperformed several of its capital city peers, highlighting its stability and long-term investment appeal.

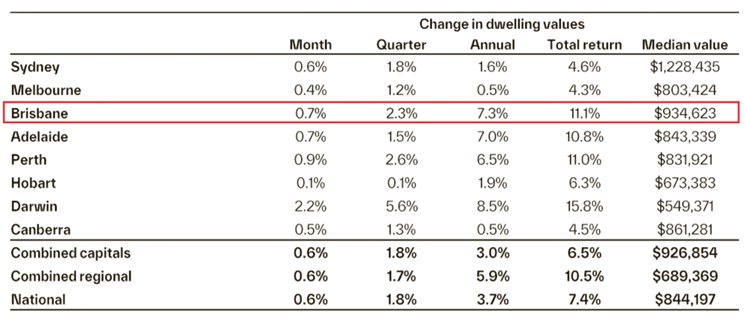

According to Cotality (formerly CoreLogic), Brisbane’s dwelling values increased by 0.7% in July, maintaining the same growth rate as June. This contributed to a quarterly rise of 2.3%, up from 2.0% the previous month, and an annual gain of 7.3%. This consistent growth places Brisbane among the top performers nationally, second only to Perth and Darwin on a monthly basis. Over a 12-month horizon, Brisbane’s market remains one of the strongest, outpacing Sydney, Melbourne, and Adelaide.

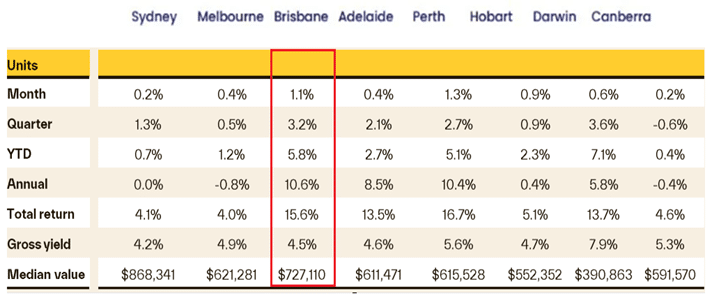

Interestingly, national data reveals a divergence between house and unit performance, with houses generally outperforming units across most capital cities. However, Brisbane continues to defy this trend, with unit values growing more strongly than houses. The unit market saw a 1.1% increase in July (up from 1.0% in June), 3.2% over the quarter, and a substantial 10.6% annual growth. This reflects heightened demand for more affordable and lower-maintenance properties, particularly in inner-city and well-serviced suburbs.

Stock Shortage, Affordability Trends, and Economic Signals

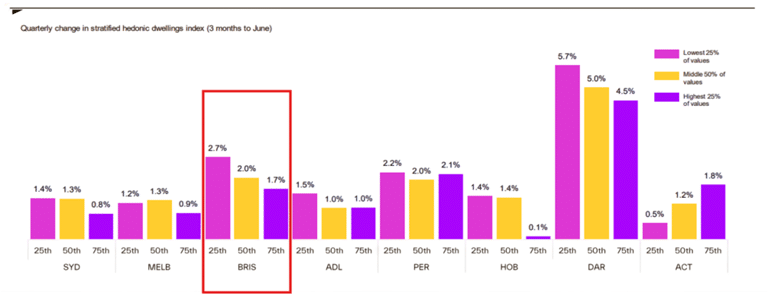

July also saw a continuation of the trend where lower-value dwellings, particularly those in the 25th percentile, recorded the strongest price growth. Affordability remains a key driver in buyer behaviour, with first-home buyers and investors targeting entry-level stock. Properties in these segments are transacting faster than premium homes, despite the overall increase in days on market from 16 days a year ago to 25 days now.

Nationally, housing value growth is skewing towards houses over units, but Brisbane stands apart as a city where the unit sector continues to shine. Furthermore, auction clearance rates in Brisbane are trending upward, signalling strong demand and an increasingly competitive market. These rising clearance rates are a leading indicator of further price appreciation over the coming months.

At a macroeconomic level, the RBA held the cash rate at 3.85% in July. While there was no immediate rate relief, the minutes revealed a clear signal that inflation is moderating and that interest rate cuts are expected soon. This supports the market’s forward-looking sentiment, particularly with expectations of a cut as early as August. Falling interest rates will boost borrowing capacities, fuel buyer demand, and potentially improve viability for stalled residential construction projects.

Adding to the challenges in housing supply, the latest Housing Accord update highlights significant underperformance. Nationally, only 134,446 dwellings were commenced in the first nine months of the period compared to a target of 180,000, creating a shortfall of over 45,000 dwellings. Queensland alone is 29.4% behind its cumulative completion target, emphasising the acute supply shortage.

While construction cost growth remains subdued by historical standards, the June 2025 quarter saw a slight uptick to 0.5% quarterly growth and 2.9% annually. These figures, although moderate, suggest persistent cost pressures that could hamper efforts to ramp up housing supply.

In July, the ABS Monthly CPI showed inflation slowing to 2.1% annually, its lowest rate since early 2021. Rent, housing maintenance, and household fuel prices remain elevated, while utility costs have softened. Meanwhile, consumer sentiment edged up to 93.1 points, suggesting a slow but steady recovery in household confidence. Though still below the optimistic threshold of 100, sentiment improved in key indicators like family finances and near-term economic outlook.

Interestingly, both the “Time to Buy a Dwelling” index and “House Price Expectations” index fell. This implies buyers remain cautious but still expect strong price growth, reinforcing the view that affordability remains a concern even as market confidence builds.

Brisbane’s listing volumes dropped in July, with 15,659 properties for sale, significantly below the long-term average of 28,000–30,000. New listings for the month totalled 6,790. This shortage of stock, combined with rising demand, continues to place upward pressure on prices.

Brisbane Dwelling Values

Source: Cotality

Brisbane’s median dwelling value now stands at $934,623, reflecting a 0.7% monthly rise, 2.3% quarterly uplift, and a 7.3% annual increase. Compared to June, quarterly growth accelerated from 2.0%, while year-on-year growth held steady. Brisbane’s values have now climbed 76.3% over five years and 93.8% over a decade, underscoring the long-term capital growth potential of the city.

Source: Cotality

While Cotality’s figures show strength across the board, Proptrack recorded a smaller 0.44% gain in July. The difference in methodologies accounts for some variation, but both datasets agree that Brisbane is in a sustained growth phase. Segment analysis shows the strongest growth continues to be in the lower quartile, which shows 2.7% quarterly growth in Brisbane, compared to 1.7% growth in the highest quartile, reflecting demand for affordable housing.

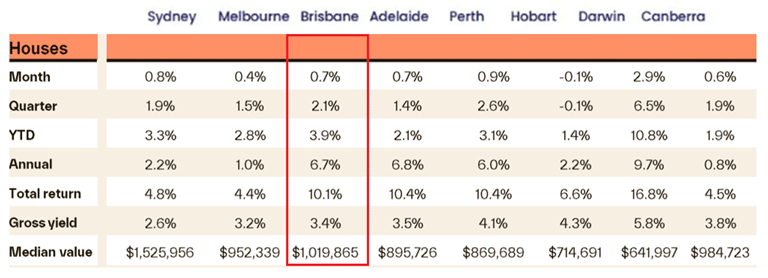

Brisbane House Values

House values in Brisbane increased by 0.7% in July, identical to June’s growth rate. The median value reached $1,019,865. Quarterly house value growth rose to 2.1%, from 1.9% in June, while annual growth edged higher to 6.7% from 6.3%, confirming a reacceleration in price growth in this segment of the market.

Proptrack reported house value growth of 0.44% for July, up from 0.2% reported in June, again demonstrating more moderate momentum in this segment.

Source: Cotality

Brisbane Unit Values

Brisbane’s unit market remains a standout performer, recording a 1.1% gain in July which is an improvement from June’s 1.0%. The median unit value now stands at $727,110. Quarterly growth increased to 3.2%, and although annual growth dipped slightly to 10.6% from 10.9%, it still far outpaces house growth.

Proptrack data corroborates this strength, showing unit values rising 0.45% in July, down from 0.6% in June.

As affordability constraints persist and borrowing power is still limited for many buyers, units continue to draw strong demand, particularly among investors and downsizers.

Source: Cotality

Brisbane’s Rental Market

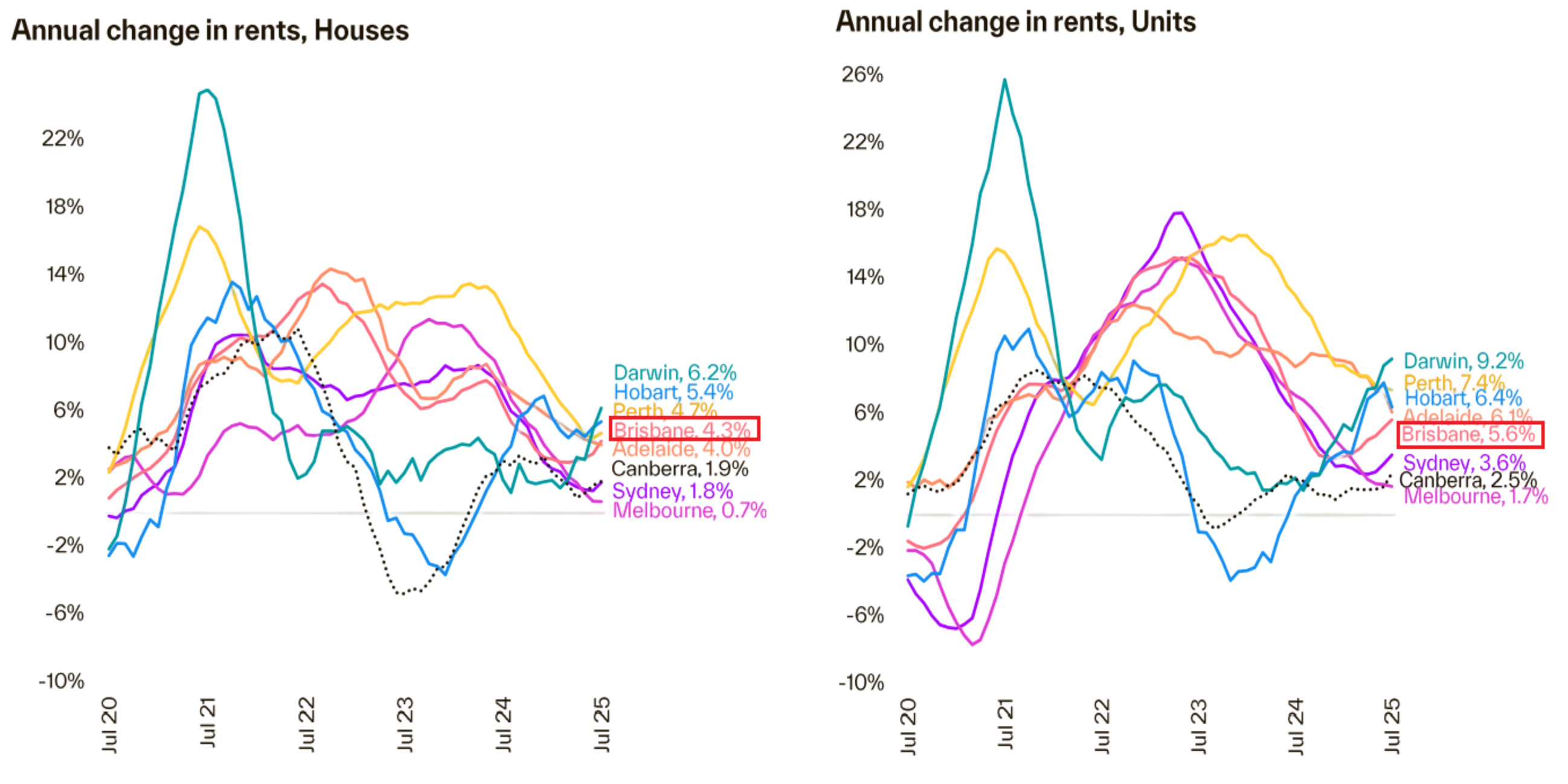

The rental market remains tight in Brisbane, with vacancy rates holding at 0.9% for the second consecutive month. Annual rent growth is reaccelerating for both houses and units. House rents increased by 4.3%, up from 3.4% last month, while unit rents rose 5.6%, up from 5.1% in June.

Source: Cotality

Source: Cotality

Gross rental yields fell slightly to 3.4% for houses (down from 3.5%) and remained steady at 4.5% for units. These healthy yields continue to attract investor interest, particularly in the unit segment where capital growth is also strongest.

Summary

The Brisbane property market continues to perform with resilience, diversity, and strong underlying fundamentals. Unit values are leading growth, especially in affordable and well-located areas. The house market remains stable, with consistent quarterly and annual gains, while rental conditions remain tight with rising rents and average yields.

Macroeconomic factors are also supportive, with inflation easing, interest rate cuts expected soon, and ongoing consumer sentiment improvements. However, challenges persist, including undersupply of new dwellings, elevated construction costs, and buyer affordability pressures.

Looking ahead, moderate price growth is expected to continue through 2025, supported by declining interest rates, improving sentiment, and strong population growth. For buyers, investors, and policymakers alike, Brisbane remains one of Australia’s most compelling real estate markets.

We hope that you have found our Brisbane Property Market Update July 2025 helpful.

Connect with us today

To book a FREE discovery call ~ Click Here