Melinda Jennison – Streamline Property Buyers

Introduction

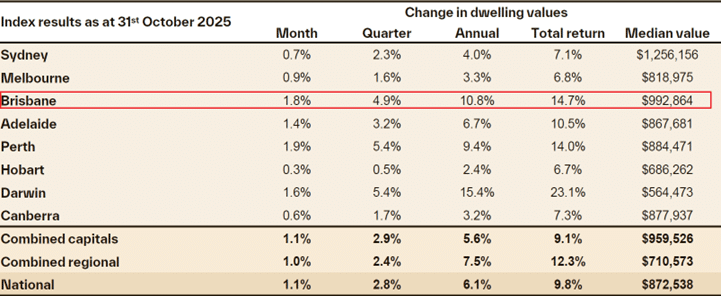

Brisbane’s housing market stepped up a gear in October, with values rising faster than in September and competition intensifying at the more affordable end of the market. Cotality’s Home Value Index shows Brisbane dwelling values rose 1.8 per cent in October, taking quarterly growth to 4.9 per cent and annual growth to 10.8 per cent, with the median dwelling value now $992,864. Over the same month, Sydney rose 0.7 per cent, Melbourne 0.9 per cent, Adelaide 1.4 per cent and Perth 1.9 per cent, placing Brisbane among the stronger capital-city performers across monthly, quarterly and annual timeframes.

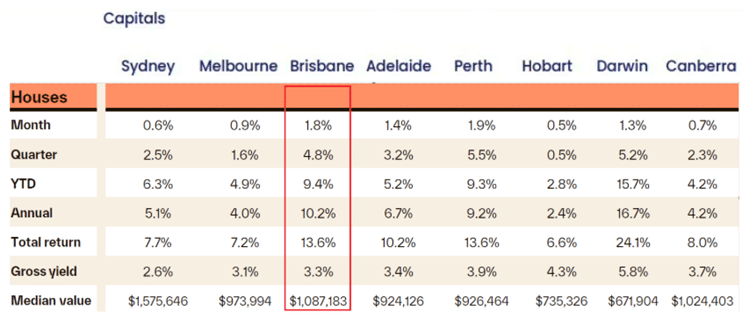

Momentum clearly improved on September’s pace. September recorded 1.2 per cent monthly growth for Brisbane dwellings and set the stage for October’s stronger result. Median values also moved meaningfully month to month: the Brisbane median house value lifted from $1,062,109 in September to $1,087,183 in October, and the median unit value rose from $755,087 to $774,498. Selling conditions firmed as well, with median days on market tightening from 22 in September to 21 in October, while auction clearance rates rose from roughly 67 per cent to 72 per cent. Listings increased month on month, but remain well below long-run norms, so the market balance still favours sellers.

Composition of demand is central to October’s narrative. Buyer activity in the more affordable price points remained much more competitive than other parts of the market, coinciding with the expanded First Home Buyer Guarantee going live on 1 October. The scheme enables eligible purchasers to buy with a 5 per cent deposit and no lenders mortgage insurance, effectively lowering upfront cost hurdles and bringing demand forward. National commentary also notes that October’s uplift in growth coincided with this guarantee commencing, with the strongest gains concentrated across the middle and lower quartiles. In Brisbane, the attached market under the $1 million cap has been especially heated. For select, well-located properties, price steps of more than $100,000 compared with a couple of months prior were evident through October as scarcity collided with buyer urgency.

The price-point asymmetry is stark. Only around 43 per cent of Brisbane suburbs have a median house value below the $1 million threshold, whereas roughly 94 per cent of Brisbane suburbs have a median unit value under $1 million. This structural reality channels a large pool of first-home buyers and budget-constrained upgraders into the attached segment, amplifying competition there.

Cotality

This dynamic aligns with the national context. Of 4,844 markets analysed by Cotality (3,514 houses and 1,330 units), 34.1 per cent had a median value at or above $1 million by September 2025, a record share up from 30.3 per cent a year earlier. Brisbane recorded the largest annual increase in $1 million markets, adding 38, ahead of Sydney’s 36 and regional NSW’s 32. This expansion of million-dollar markets helps explain why sub-$1 million segments feel so crowded. More areas have tipped over the threshold, forcing price-sensitive demand to concentrate where it still fits.

Brisbane has also posted strong five-year growth, though this is not unprecedented for fast-growing capitals. One nuance is that units continue to outpace houses, an uncommon pattern among the capitals, owing to low attached-stock supply, strong investor participation, affordability constraints and earlier under-valuation.

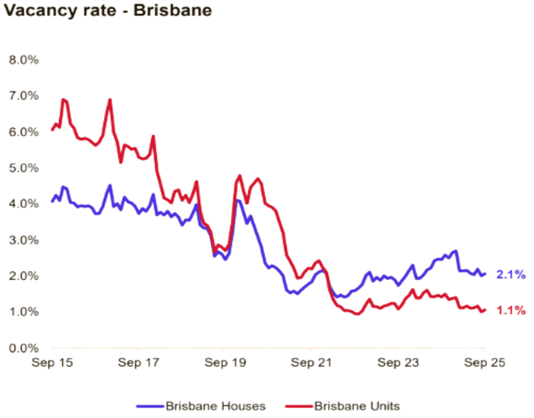

Supply remains the binding constraint. While purchasing demand is above average, total advertised stock is still well below the long-term benchmark. October’s total listing volumes lifted to 16,284 according to Cotality and new listings to 8,132 across Greater Brisbane, yet the stock pool remains materially lower than the long-run average of around 28,000 to 30,000. The number of unit listing in Brisbane has now fallen well below both the 5 year and 10 year average.

Cotality

Monetary policy and household resilience add important context. The cash rate was left unchanged in October. The RBA’s October Financial Stability Review indicates just over 2 per cent of variable-rate owner-occupier borrowers are estimated to have a cash-flow shortfall, down on a year ago. Arrears remain low, though higher LVR and LTI cohorts are more vulnerable. There are fewer than 1 per cent of households who are currently in a negative equity position. And, even under a severe downturn, fewer than 4 per cent are estimated to face severe repayment risk. Lending standards remain prudent, but the RBA cautions that, if financial conditions ease, there is a risk households take on excess leverage. These signals suggest most mortgaged households are positioned to cope, but regulators will remain vigilant, especially given investor credit growth has accelerated in 2025.

Brisbane Dwelling Values

Brisbane dwelling values rose 1.8 per cent in October, up from 1.2 per cent in September. The quarter rose 4.9 per cent and the annual pace is now 10.8 per cent, placing Brisbane near the top of the capitals across all three horizons. The city’s median dwelling value is $992,864. Nationally, combined capitals rose 1.1 per cent over the month and 2.9 per cent over the quarter, illustrating Brisbane’s outperformance.

Cotality

Market mechanics continue to favour Brisbane’s lower-priced segments, consistent with the effect of affordability constraints and the expanded deposit guarantee.

Cotality

PropTrack also reported a positive month, noting Brisbane’s broad price growth pulse.

Brisbane House Values

House values increased 1.8 per cent in October, lifting quarterly growth to 4.8 per cent and annual growth to 10.2 per cent. The median house value reached $1,087,183 in October, up from $1,062,109 in September. PropTrack reported similar directional momentum for detached housing during October.

Cotality

Brisbane Unit Values

Units led again in October, rising 1.9 per cent for the month, 5.3 per cent for the quarter and 14.0 per cent over the year. The median unit value lifted to $774,498 in October from $755,087 in September. This attached-sector leadership is unusual among capitals, and reflects constrained attached-stock supply, investor participation, and price-point accessibility for first-home buyers and budget-constrained households in Brisbane.

PropTrack’s October result for units aligned with the positive trend reported by Cotality.

Cotality

The supply picture helps explain the pace of unit price growth. In this lean-inventory environment, competition for quality, well-located units remains intense.

While houses are still advancing, Brisbane’s unit market continues to grow faster, narrowing the house–unit value premium that had blown out during the pandemic.

The divergence between houses and units has historical context. The house-to-unit premium in Brisbane surged to around 80 per cent by April 2022 and has since compressed to roughly pre-pandemic norms, consistent with the idea that units were previously under-valued and are now re-rating as relative affordability drives demand into attached stock. This is reinforced by October’s stronger monthly reading for units than houses and by the concentration of buyer competition in the sub-$1 million bracket.

Brisbane’s Rental Market

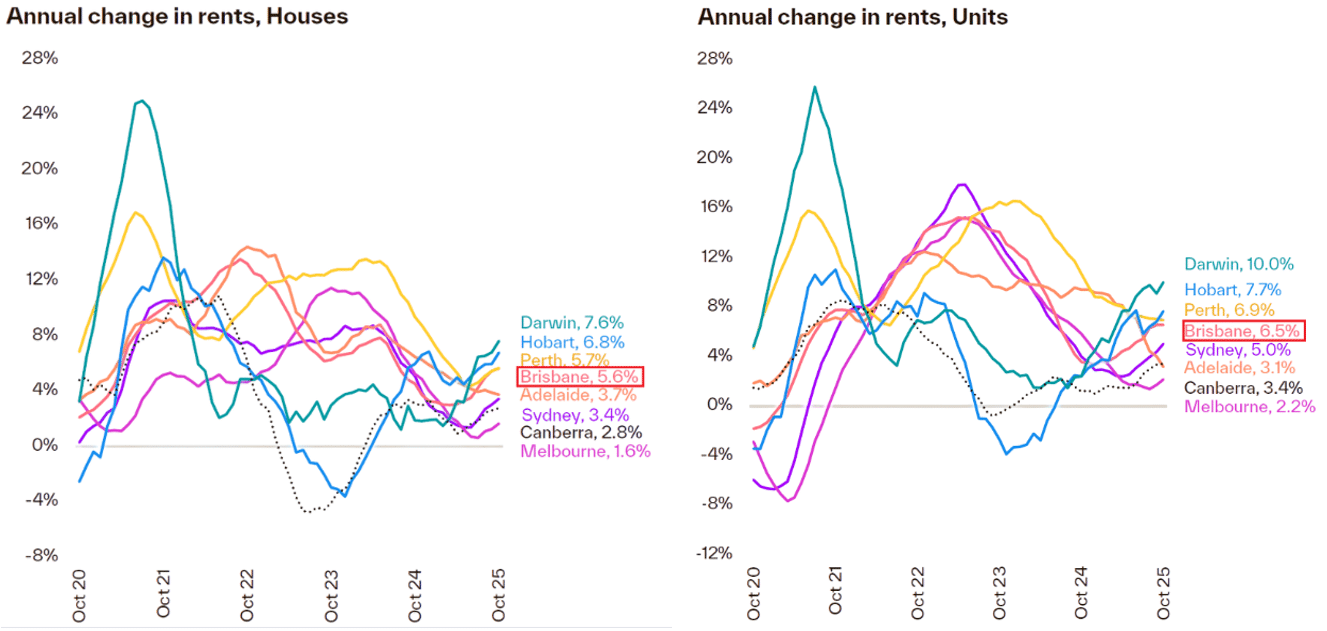

Rental conditions remain extremely tight. Brisbane’s rental vacancy rate remain near record lows and indicative of persistent imbalance. Rents are re-accelerating with annual house rent growth of 5.6 per cent and unit rent growth to 6.5 per cent over the year to October, both higher than in September.

Cotality

Gross yields edged down as prices rose faster than rents. Houses sat around 3.3 per cent in October, a little lower month on month, and units at 4.2 per cent, down 0.1 percentage point from September. This pattern is consistent with the broader national picture of rent growth firming but value growth running slightly faster, compressing yields at the margin.

Cotality

Investor and first-home buyer activity are both important features of the current cycle. Investors accounted for about 38.3 per cent of Queensland housing finance commitments, while first-home buyers comprised roughly 27 per cent. These shares align with the on-the-ground competition being observed at affordable price points and likely to be sustained by the guarantee scheme through late 2025 and into 2026.

Summary

October underlined Brisbane’s transition from strong to very strong conditions. Prices rose faster than in September, days on market shortened, clearance rates firmed, and listings, remained well below long-term norms. Demand is most concentrated in the more affordable segments, especially sub-$1 million attached properties, where the expanded First Home Buyer Guarantee has added another tailwind to already-tight conditions. Units continue to outpace houses, reflecting constrained supply, investor participation and the re-rating of previously under-valued attached assets.

There are clear headwinds. Housing remains unaffordable for many, and the path to lower interest rates is not straightforward. Slower population growth implies softer underlying demand than earlier in the cycle. Regulators are likely to stay vigilant, particularly if investor credit accelerates, and global uncertainty still weighs on sentiment and policy settings. Significant barriers to new housing supply persist, from planning and approvals to construction costs and capacity.

At the same time, there are meaningful supports. National and state economies are expected to improve gradually through 2026, labour markets remain relatively tight, especially in Queensland, and the cumulative undersupply of listings, new product and rental accommodation should continue to underpin values.

In summary, low stock across both for-sale and rental markets looks likely to persist. A further broad-based rise in home values and rents appears the most probable path near term, but the extent of growth will be capped by affordability and serviceability constraints. Regulators are likely to be watchful for excessive credit growth, particularly among investors with some banks already halting lending to Trust structures. First-home buyer participation should strengthen as incentives bed in.

For Brisbane, the immediate outlook remains firm, with attached dwellings leading gains and well-located houses continuing to appreciate, albeit at a slightly more measured pace than units.

We hope that you have found our Brisbane Property Market Update October 2025 helpful.

Connect with us today

To book a FREE discovery call ~ Click Here