Brisbane continues to capture national and international attention as one of Australia’s most dynamic property markets. In a recent webinar hosted by Streamline Property Buyers in partnership with Mike Mortlock from MCG Quantity Surveyors, we unpacked the drivers of capital growth in Brisbane.

From housing supply constraints to the demand created by interstate migration, affordability, and lifestyle appeal, the city is at a unique crossroads. In this blog, we’ll recap the key themes, supported by charts and insights from the session.

View the webinar:

Brisbane’s Fundamentals: Why Capital Growth is Strong

The foundation of Brisbane’s growth story lies in the imbalance between supply and demand. While demand is being fueled by strong migration, relative affordability, and strong economic performance, supply remains stubbornly constrained.

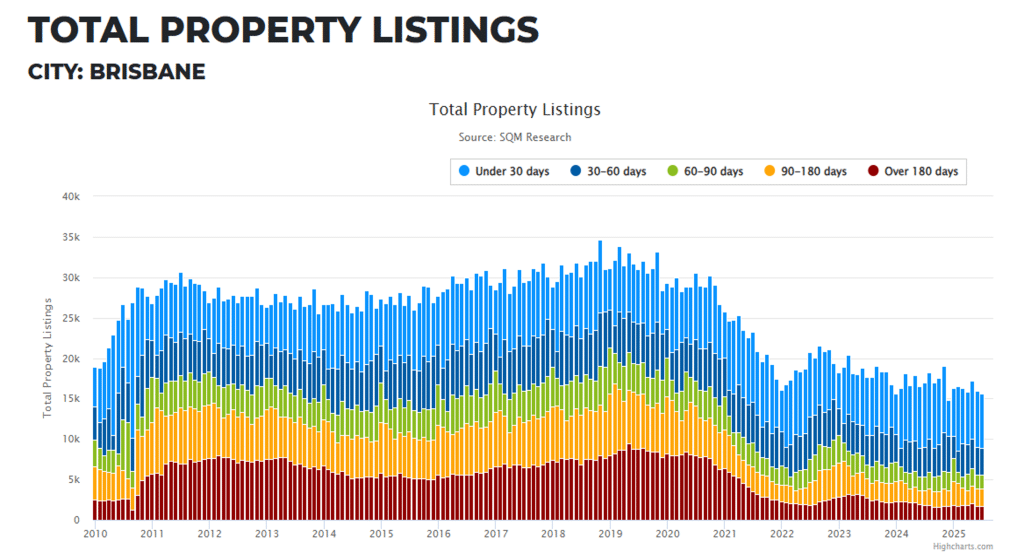

Source: SQM Research

With listings consistently below average, competition among buyers intensifies, keeping upward pressure on prices.

Rising Costs and Supply Pressures

New housing supply is not keeping pace with government targets. Nationally, we are already tens of thousands of dwellings short of federal targets. In Queensland, completions are nearly 30% behind schedule.

This is compounded by rapidly escalating costs. The average price of a greenfield house-and-land package in Brisbane has surged from $500,000 in 2020 to over $830,000 in 2023.

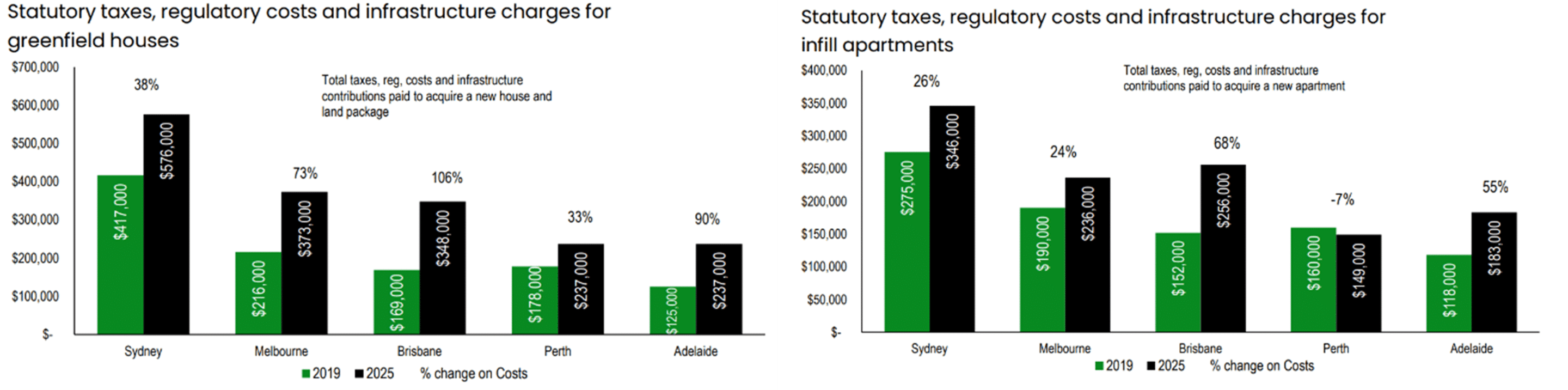

Source: HIA Economics

Additionally, statutory taxes, regulatory costs and infrastructure changes for all dwelling types across Brisbane continue to escalate – placing more pressure on rising prices across all housing sectors.

Source: HIA Economics

These affordability constraints mean fewer new dwellings are being delivered, exacerbating supply shortages.

Changing Housing Composition

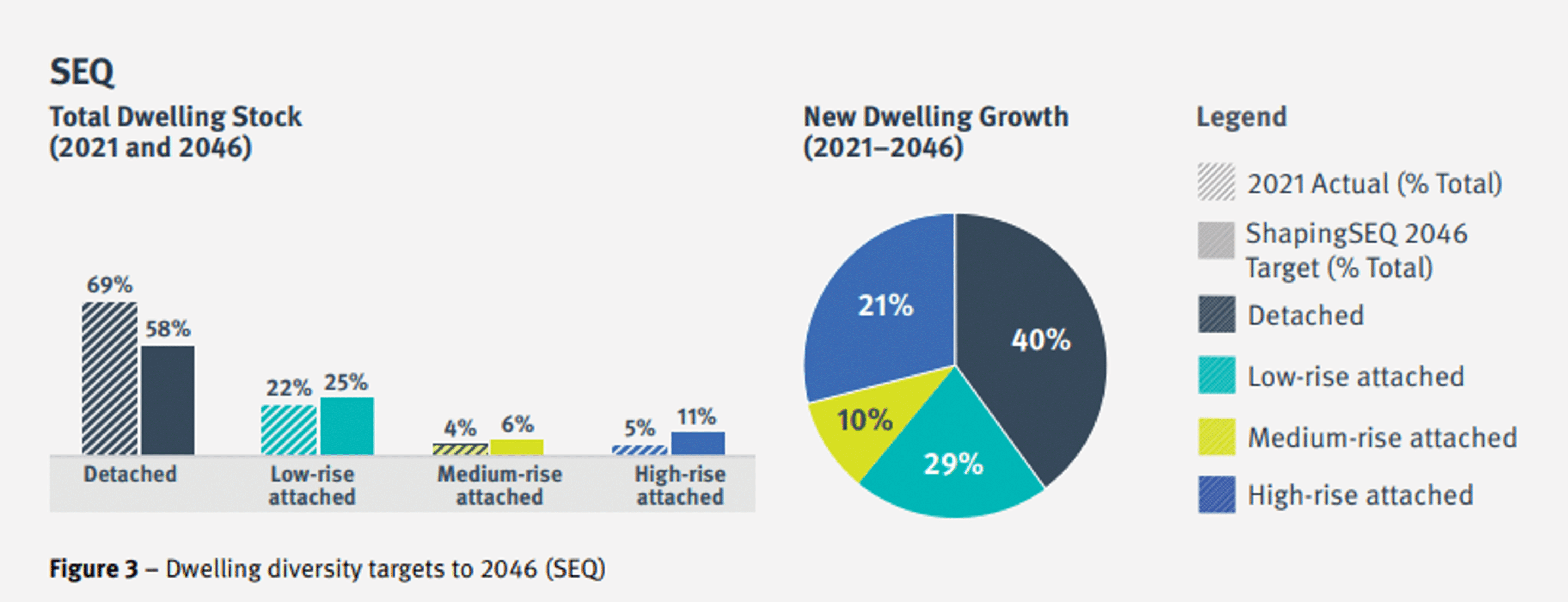

Historically, Brisbane has been a city of detached homes and large blocks. That is shifting. Between 2021 and 2046, detached housing as a share of supply is forecast to shrink from 69% to 58%.

Source: Shaping SE Qld 2023

The future will see more medium-density, low-rise attached dwellings, and apartments. However, not all areas are equally able to accommodate this growth due to heritage overlays and character housing protections.

Local Government Area (LGA) Insights

Understanding where new dwellings will be delivered across Greater Brisbane is critical for buyers and investors.

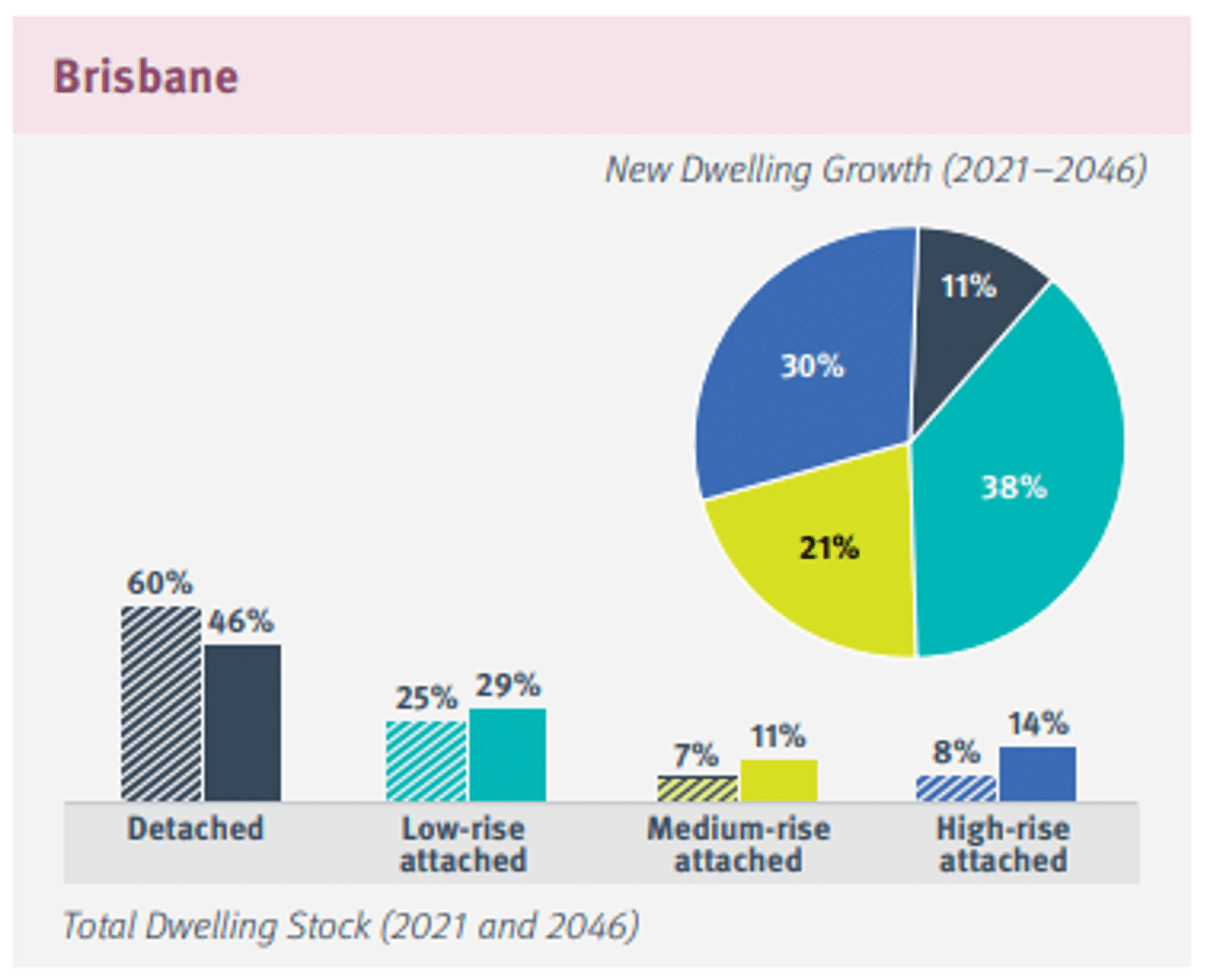

Source: Shaping SE Qld 2023

Brisbane City Council

- Largest LGA in Australia, stretching 20–30 km from the CBD.

- Infill development dominates, with most detached land already exhausted.

- Growth will come from low-rise and medium-rise dwellings, alongside some high-rise.

- Small remaining greenfield pockets exist south near Rochedale, but much of the land is flood-affected or undevelopable.

Ipswich

- Significant greenfield capacity, making it a hub for detached housing.

- Affordability compared to inner Brisbane ensures it remains attractive for both home buyers and investors.

- However, infrastructure and commute times are key considerations.

Source: Shaping SE Qld 2023

Logan

- Strong population growth and diverse supply.

- Both greenfield estates and townhouse developments play a role.

- Attractive for budget-conscious buyers, but infrastructure delivery needs to keep up.

Source: Shaping SE Qld 2023

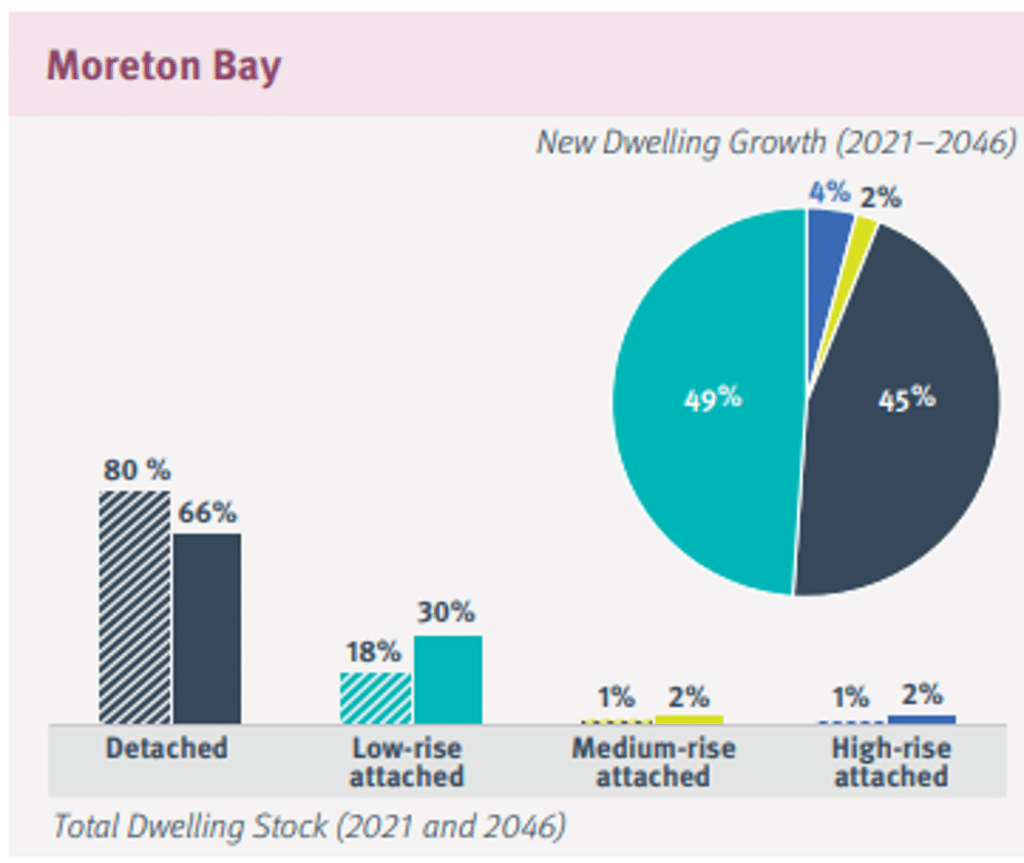

Moreton Bay

- One of the most active growth corridors, benefiting from infrastructure upgrades.

- Large portions of new supply will come from greenfield subdivisions, though costs remain a barrier.

- Expect more townhouses and small-lot detached homes as density increases.

Source: Shaping SE Qld 2023

Redlands

- Growth is more constrained by geography and environmental overlays.

- Detached housing remains dominant, though townhouse projects are emerging in key hubs.

Source: Shaping SE Qld 2023

Demand Drivers

Even as supply struggles, demand for Brisbane property remains strong:

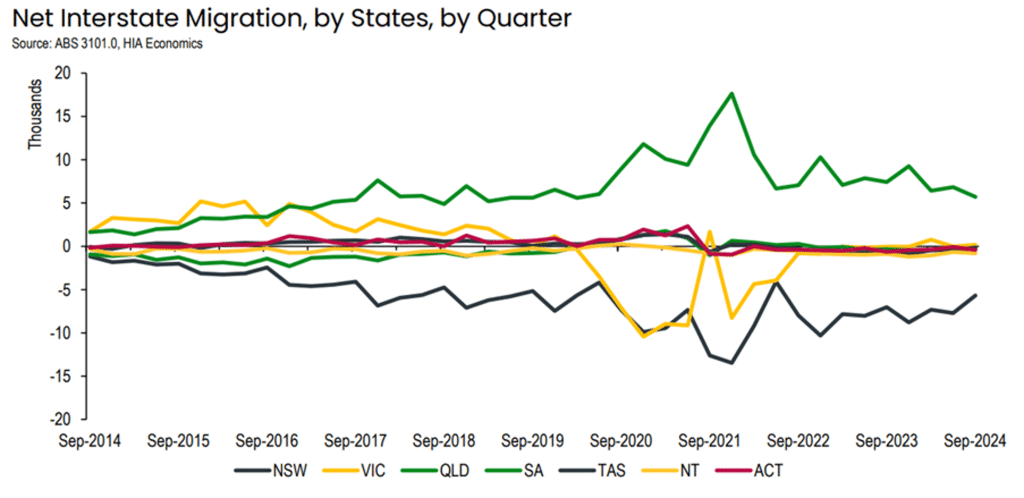

- Migration: Queensland leads the nation in net interstate migration

Source: HIA Economics/ABS

- Affordability: Brisbane has lower transaction costs, such as stamp duty, than many other locations across Australia.

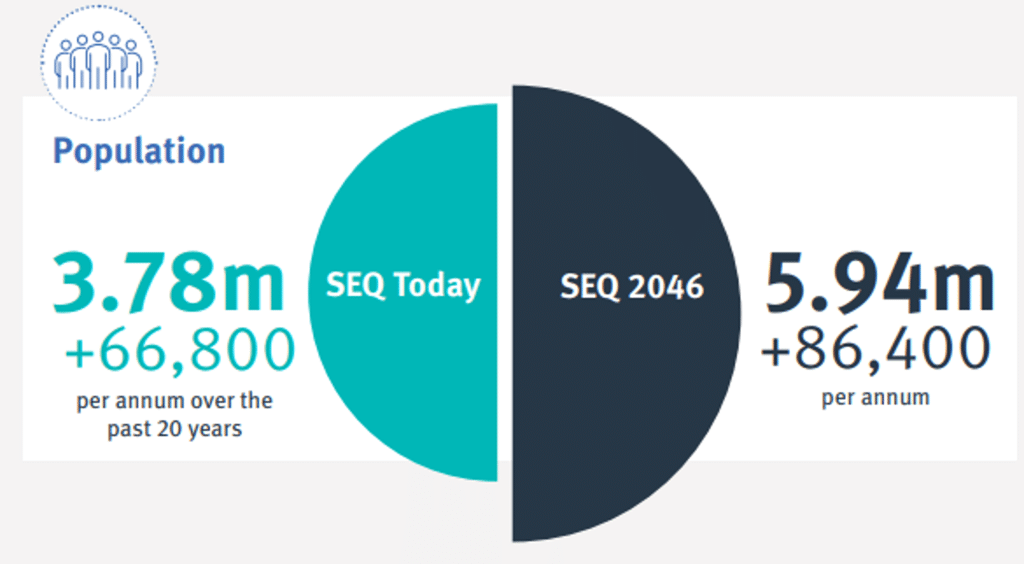

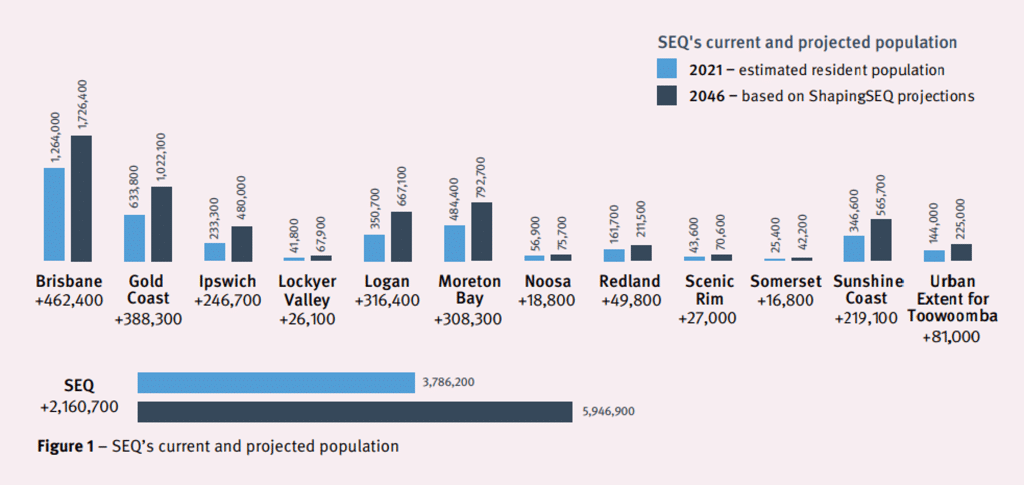

- Population Growth: Long-term projections are robust, particularly in SEQ, but not all local government areas are set to see the same levels of population growth

Source: Shaping SEQ 2023

Source: Shaping SEQ 2023

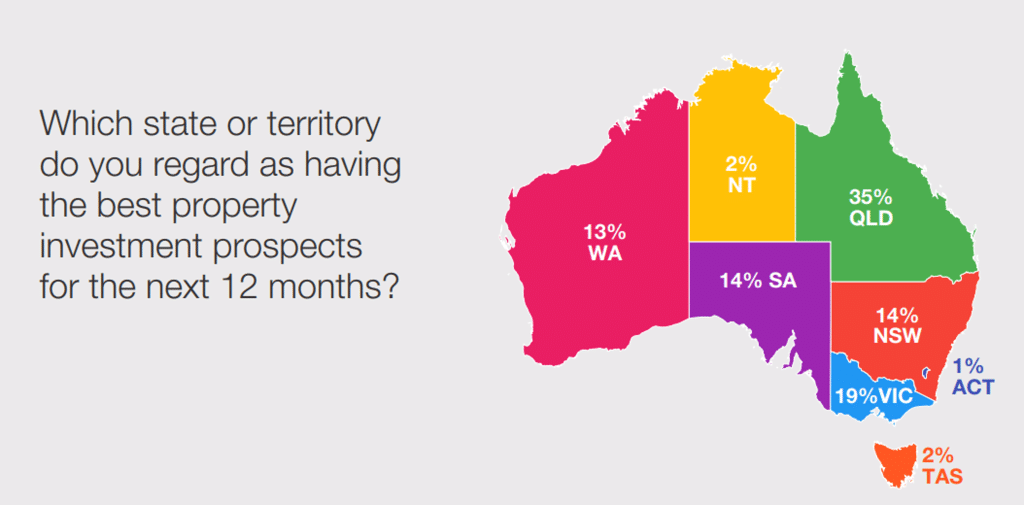

- Investor Sentiment: Surveys show investors view Brisbane as one of the top growth markets.

Source: API

Conclusion

Brisbane is in the midst of a structural shift. Supply challenges, rising costs, and planning overlays mean housing delivery will increasingly rely on infill and medium-density dwellings, particularly in LGAs like Brisbane, Moreton Bay, Logan, and Ipswich.

At the same time, migration, affordability, and strong demand fundamentals ensure Brisbane remains a standout for property investors seeking capital growth in Brisbane. For structured commercial property acquisitions, see our dedicated Commercial Buyers Agent service.

For buyers and investors alike, the message is clear: understand the supply pipeline at an LGA level, align with future growth corridors, and factor in both character overlays and infrastructure delivery.

If you’d like expert guidance on where to find the best opportunities for capital growth in Brisbane, reach out to the Streamline Property Buyers team today.

Connect with us today

To book a FREE discovery call ~ Click Here

Follow us on LinkedIn | YouTube | Instagram | TikTok

Tune into our podcast ~ Brisbane Property Podcast