Buying a property in Brisbane can feel overwhelming, especially for first-time buyers or those unfamiliar with the local market. Our buyers agent services can make the process simpler, from arranging finance to final settlement, there are multiple steps to consider. This guide breaks down the entire buying process, helping you understand how to buy a property confidently, make informed decisions, and secure a property that meets your goals.

Step 1 – Get Finance Ready: How to Prepare for Buying a Property

Before you start searching for your ideal property investment, it’s essential to get your finances in order. This step ensures you know your borrowing capacity, budget, and the loan structure that best suits your situation. Key actions include:

- Assessing your income and expenses: Understand your cash flow and commitments.

- Checking your credit score: A strong credit history can improve your borrowing power.

- Considering loan options: Fixed, variable, or interest-only loans may suit different investment strategies.

- Understanding your borrowing power: How much you can realistically borrow determines your price range.

By preparing financially first, you set yourself up for a smoother property search and avoid disappointment later in the process.

Step 2 – Saving for a Deposit: How Much You Need to Buy a Property

The deposit is one of the most significant upfront costs in property buying. In Brisbane, property prices vary by suburb, so it’s important to calculate your target deposit accurately. Key considerations include:

- Deposit size: Typically 10–20% of the property price, depending on lender requirements.

- Government incentives: First Home Owner Grant (FHOG) and stamp duty concessions may help reduce costs.

- Additional costs: Include stamp duty, legal fees, inspection fees, and loan application fees.

- Saving strategies: Budget carefully, automate savings, and review your expenses regularly.

A well-planned savings approach ensures you can make competitive offers without financial strain.

Step 3 – Getting Pre-Approval for Your Property Loan

A pre-approved loan demonstrates to sellers that you are a serious buyer and confirms your budget. To obtain pre-approval:

- Prepare your documents: Payslips, bank statements, tax returns, and identification.

- Apply to lenders: Submit your pre-approval application to understand your borrowing capacity.

- Review loan terms: Ensure the interest rate, loan structure, and repayment plan suit your financial goals.

With pre-approval, you can move quickly when you find the right property and avoid delays that could jeopardize your offer.

Step 4 – How to Search for the Right Property in Brisbane

Searching for a property requires a clear plan and defined criteria: location, budget, and property type. Tips for a successful property search:

- Research Brisbane suburbs: Look for population growth, infrastructure projects, rental demand, and capital growth potential.

- Online listings and agencies: Check websites, apps, and agents’ listings for on-market opportunities.

- Off-market properties: Engage a buyers’ agent to access off-market options that may not appear online.

- Prioritize your needs vs. wants: Consider lifestyle factors, commute times, school catchment, and amenities.

By narrowing your search and using professional guidance, you increase your chances of finding a property that aligns with your goals.

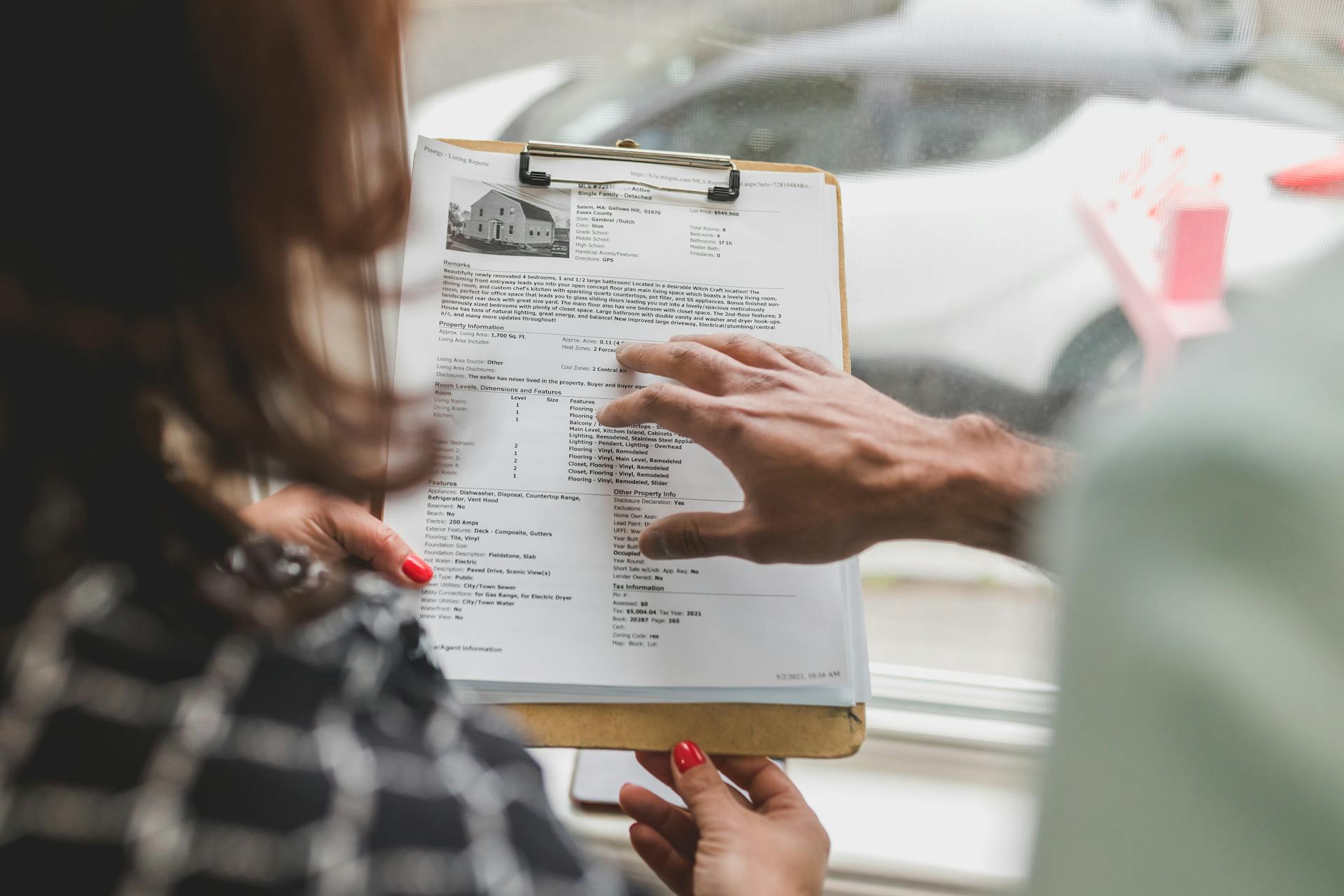

Step 5 – Making an Offer: How to Buy a Property with Confidence

Making an offer can be stressful, but preparation makes the process smoother. Key steps include:

- Assess market value: Compare recent sales of similar properties in the area.

- Include conditions: Building and pest inspections or finance approval clauses protect your interests.

- Negotiate strategically: Understand seller motivations, market trends, and timing.

A carefully prepared offer increases your chances of acceptance while minimizing risk.

Step 6 – Conditional vs. Unconditional Contracts Explained

Many buyers ask: “What’s the difference between conditional and unconditional contracts?”

- Conditional contracts: Include clauses allowing due diligence, such as building and pest inspections, finance approval, and strata review (for apartments).

- Unconditional contracts: Remove conditions, committing fully to the purchase.

Understanding contract types helps you make informed decisions, manage risks, and ensures that you don’t commit before completing essential checks. We have written an in depth Article on the Contract Process in Queensland for you to check this further.

Step 7 – Settlement: What Happens After You Buy a Property

Settlement is the final stage where ownership transfers from the seller to the buyer. Key points include:

- Settlement timelines: Usually 30–90 days depending on the contract.

- Final payments and adjustments: Includes rates, utilities, and body corporate fees.

- Handover of keys and documents: Ensures you can move in and take ownership seamlessly.

Understanding settlement reduces stress and prepares you for a smooth transition into your new property.

How Streamline Property Buyers Supports Your Brisbane Property Purchase

At Streamline Property Buyers, one of Brisbane’s most awarded buyers agents, your goals come first. Whether you’re looking for a family home or investment property, we provide expert guidance every step of the way:

- Identifying the right property based on your goals and budget.

- Preparing competitive offers and negotiating terms.

- Accessing off-market opportunities for exclusive options.

- Safeguarding your interests throughout the contract and settlement process.

Our team’s personalized approach ensures you can buy with confidence, reduce stress, and make decisions that align with your long-term property investment goals.

Connect with us today

To book a FREE discovery call ~ Click Here

Follow us on LinkedIn | YouTube | Instagram | TikTok

Tune into our podcast ~ Brisbane Property Podcast